Gold has done better than silver and the PGMs, which shows that institutions are more committed to the yellow metal. However, Ross Norman, CEO of Metals Daily, says that the whole precious metals complex is still responding more to speculative flows than to fundamental reasons.

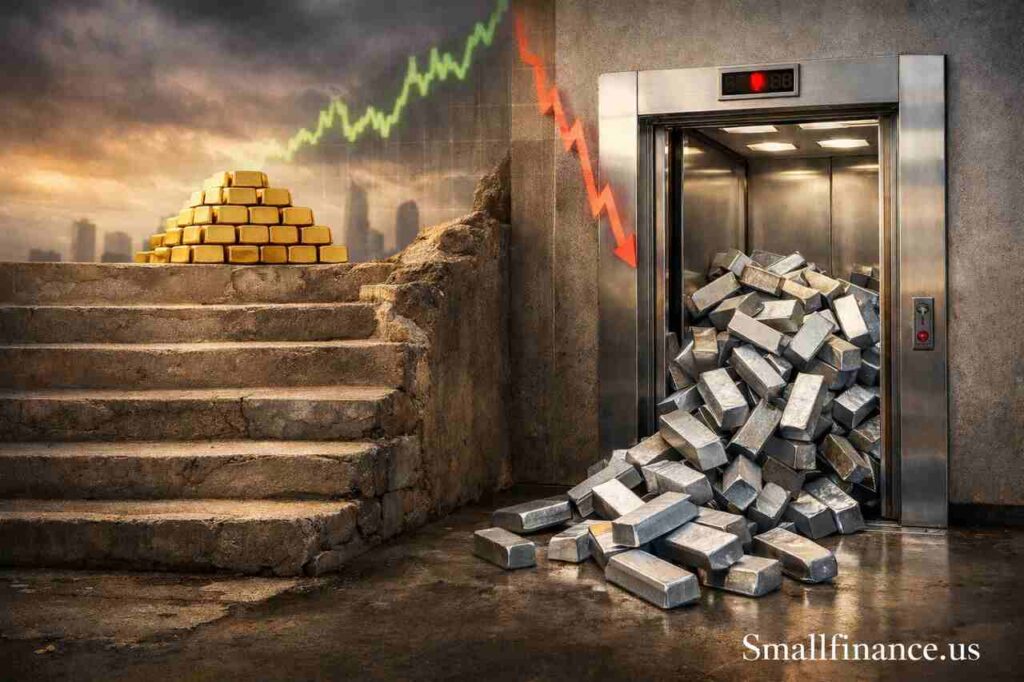

Norman recently did an analysis that showed that the prices of precious metals were once again following the usual pattern of going up the “stairs” slowly and then quickly going down.

“January saw dramatic rallies and record highs across the complex. February, on the other hand, saw sharp corrections, partial recoveries, momentum loss, and then more volatility, leaving the market in an unclear consolidation phase,” he said. “Right now, Chinese derivatives plays are having a huge effect on price action, and the moves often go against the fundamentals.” In short, markets are getting out of hand and hard to understand.

“When trading is this unstable, small investors lose money, big players leave, industrial clients work even harder to find alternatives, central banks stop trading, and specs end up competing with each other in a zero-sum game,” he said. “Not helpful.”

Norman said that traditional technical analysis would need to see a pullback of about 50% after a big drop in price to be sure that the bull market would continue. He said, “Most metals have only partly recovered, stopping short of key resistance levels before entering trading ranges.” “This makes a “amber light” situation: it’s good for bulls because of how quickly prices are rising despite macro headwinds like stronger U.S. data, a strong dollar, and delayed Fed rate cuts, but it’s not enough for bears to call a clear top.”

Norman said that gold is the best performer right now because it has broken through this 50% retracement level and is now only selling 12% below its recent price peak.

“Structural support from central bank accumulation, de-dollarization trends, and worries about sovereign debt persists,” he said. “Physical demand is still very high, with bullion showrooms in the UK, Europe, and Asia reporting “off-the-scale” interest. Indian premiums are close to but not quite at decade highs, even though prices are high, and Chinese seasonal demand has slowed down a bit.”

“Strong Asian offtake supports the idea that the bull market as a whole is structurally intact,” he said. “However, short-term price action is dominated by speculative flows and exchange margin adjustments.”

Silver, on the other hand, has been the weakest. It is still about 38% below its all-time high of $122 an ounce set in January.

“Its huge gain of about 60% in January was mostly due to speculation, which was faster than the fundamentals and left it open to deleveraging,” Norman said. “It’s good that the recent drop in silver has taken away most of the Chinese spec positions on SGE, but they will be back.” Even though there have been supply shortages for six years in a row and strong demand in jewelry and industry, these factors are not affecting the current situation. Samsung and other companies are making solid state batteries that will change the market. If these batteries are used in about 10% of vehicles, or 1 kg per car, they will create a new need for between 6,000 and 8,000 tonnes of silver by 2035, which is about a fifth of the world’s mine supply.

“End users are worried about extreme volatility. For example, the big jewelry company Pandora is switching to platinum-plated products to lower their silver exposure,” he warned.

When Norman talked about platinum-group metals, he said that platinum prices rose almost 50% in January, getting closer to $3,000 an ounce. However, they have since lost all of their 2026 gains and dropped even more.

“Like its peers, it faces speculator fatigue in a time of coordinated selling of hard assets,” he wrote. “Fundamentals remain supportive, including limited supply, backwardation, and high lease rates, but macro factors and derivatives-driven deleveraging, which is made worse by global margin hikes, especially on China’s GFEX, are the main drivers of change.” When there is a lot of instability, it’s hard for industrial clients to make plans.

“Palladium rose about 36% in January, but all of those gains were lost in early February. It is now trading near $1,650–$1,680/oz, about the same as it was at the beginning of the year,” he said. “Demand goes up because more hybrid cars are being made and industrial uses (AI, electronics, and catalysts, up about 5% year over year), but supply goes down about 3% because of problems in South Africa and lower mine output in North America.” Recycling helps to some degree.

The most important thing Norman learned from the recent success of precious metals is that fundamentals are still not driving prices.

Short-term price changes in the complex are mostly caused by large-scale speculation, big changes in initial margins on futures exchanges, stop-loss cascades, the strength of the dollar, the U.S. economy (strong jobs data pushing rate-cut expectations to the summer), and stop-loss orders, rather than fundamentals, he wrote. “For long-term players, nothing changes as the basics become more important. For nervous, short-term players, get used to being technically right but financially wrong, and also to getting stopped out.”

Norman said that the relatively strong performance of gold “highlights institutional conviction,” while the more severe price drops and weaker retracements in silver and platinum “reflect leveraged excess unwinding.”

“Physical indicators, especially Asian demand, suggest the structural bull case will last,” he said. “However, repeated flash volatility risks reducing the number of investors who are willing to participate.” “The next big event that changes the direction of prices will probably be the next set of U.S. inflation data.”