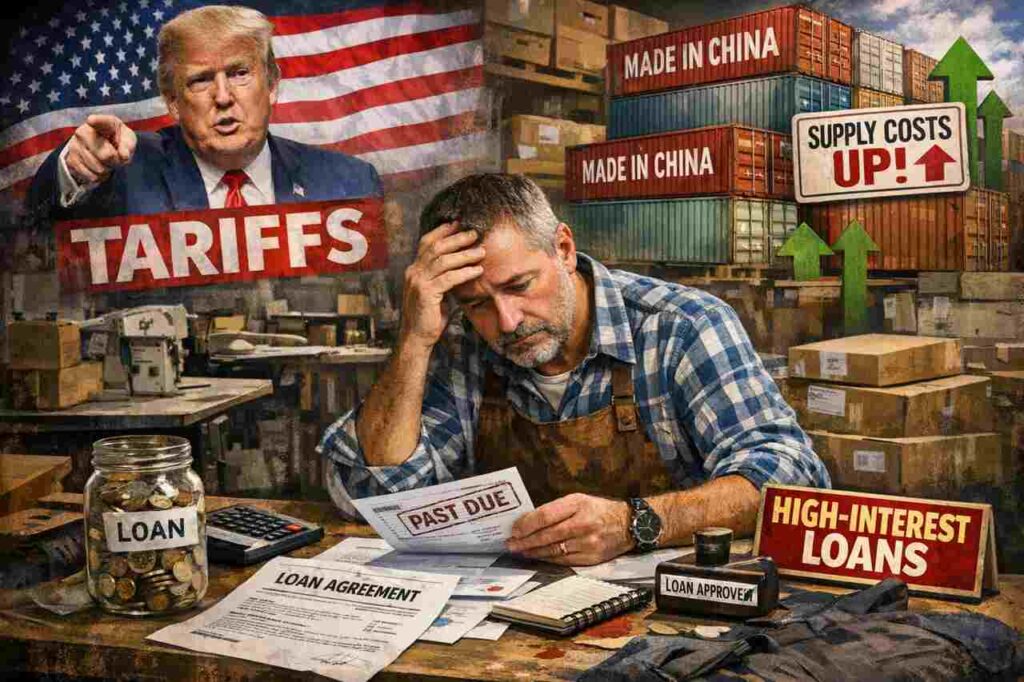

Why Are Trump-Era Tariffs Forcing Small Businesses Into High-Interest Debt?

Small businesses are absorbing elevated operational costs due to revived Trump tariffs on imported goods, especially from China. These tariffs—targeting raw materials, electronics, and machinery—create artificial price inflation across manufacturing and retail sectors. To offset immediate financial pressure, many SMEs (Small and

Medium Enterprises) are seeking short-term, high-interest financing, raising liquidity concerns and exposing vulnerabilities in the domestic business ecosystem.

What Are the Key Tariff Categories Affecting Small Businesses?

Tariffs on industrial machinery and parts:

Small manufacturers relying on Chinese machinery imports face surging input costs. With alternative suppliers limited or priced higher, tariff-driven inflation disrupts production timelines and reduces profit margins. For example, CNC machines, tooling parts, and essential automation equipment are now up to 25% more expensive.

Tariffs on electronic components and semiconductors:

Retailers and consumer electronics startups are disproportionately affected due to heavy reliance on microchips and integrated circuits from East Asia. The imposed duties make end-products more expensive, reducing competitiveness and stalling growth in tech-centric markets.

Tariffs on metals and construction materials:

Steel and aluminum tariffs inflate costs for contractors, builders, and product manufacturers. This price pressure cascades into local economies, forcing small construction firms and hardware suppliers to accept unfavorable credit terms or delay projects.

Tariffs on consumer goods and finished products:

SMEs operating in e-commerce or retail face margin compression from higher acquisition costs for products like furniture, apparel, and electronics. The need to maintain price parity with larger competitors creates a financial imbalance.

How Are High-Interest Loans Becoming the Default Financial Strategy?

Limited access to traditional bank lending:

Community banks and credit unions are tightening credit conditions in response to economic volatility. Small business owners, lacking strong collateral or long credit histories, are pushed toward non-bank lenders or merchant cash advances, which often carry annualized rates over 30%.

Bridge financing to handle disrupted cash flow:

Inventory delays caused by tariff-related supply chain bottlenecks reduce sales cycles and operating cash flow. Short-term loans are being used to cover payroll, rent, and logistics during slow sales periods.

Inflation-linked loan structures:

Many non-traditional financing options are pegged to inflationary indexes. As cost-of-goods sold (COGS) increases due to tariffs, interest payments scale upward, turning these financial instruments into long-term liabilities.

Increased reliance on invoice factoring and asset-based lending:

To convert receivables into immediate liquidity, SMEs are turning to factoring services at high discount rates. While this provides operational breathing room, it erodes long-term profitability and signals distressed financial posture.

What Are the Economic and Competitive Risks to Domestic Enterprises?

Reduced ability to scale or reinvest in innovation:

Debt servicing obligations limit capital reinvestment into R&D, employee training, or product development. Over time, this stagnates innovation and reduces global competitiveness, especially in tech-driven industries.

Weakened labor market resilience in small firms:

As cash reserves shrink, small businesses delay hiring, freeze wages, or reduce hours. Labor-intensive industries such as food services, construction, and logistics are hit hardest, leading to regional unemployment fluctuations.

Vulnerability to market shocks or policy shifts:

Firms with high debt-to-equity ratios are less able to absorb additional regulatory changes, interest rate hikes, or geopolitical shifts. Their fragile financial state limits responsiveness to emerging opportunities or market pivots.

Consolidation and buyouts by larger entities:

Struggling SMEs become acquisition targets for larger corporations or private equity groups. While this may offer short-term relief, it contributes to reduced market diversity and centralizes economic power, further marginalizing small enterprises.

How Are Supply Chain Dynamics Altered by Tariff Policy?

Shift toward domestic sourcing with limited supplier capacity:

To bypass tariffs, many SMEs attempt to localize their supply chains. However, domestic producers lack the scale or infrastructure to meet increased demand, leading to bottlenecks and inflated prices.

Diversification to Southeast Asian and Latin American suppliers:

Businesses explore alternative sourcing from Vietnam, Mexico, and India. Transitioning to these suppliers incurs new costs in compliance, logistics, and relationship building, offsetting immediate savings from tariff avoidance.

Increased warehousing and inventory carrying costs:

To mitigate tariff shocks and stockouts, companies overstock critical components, increasing storage expenses. This ties up working capital and raises the risk of obsolescence for fast-moving consumer goods.

Reliance on freight intermediaries and third-party logistics (3PL):

Navigating new trade routes and customs regulations increases dependency on logistics partners, who often charge premiums for expedited services and supply chain risk mitigation.